The Perception of Capital-Intensive Hardware vs. Software

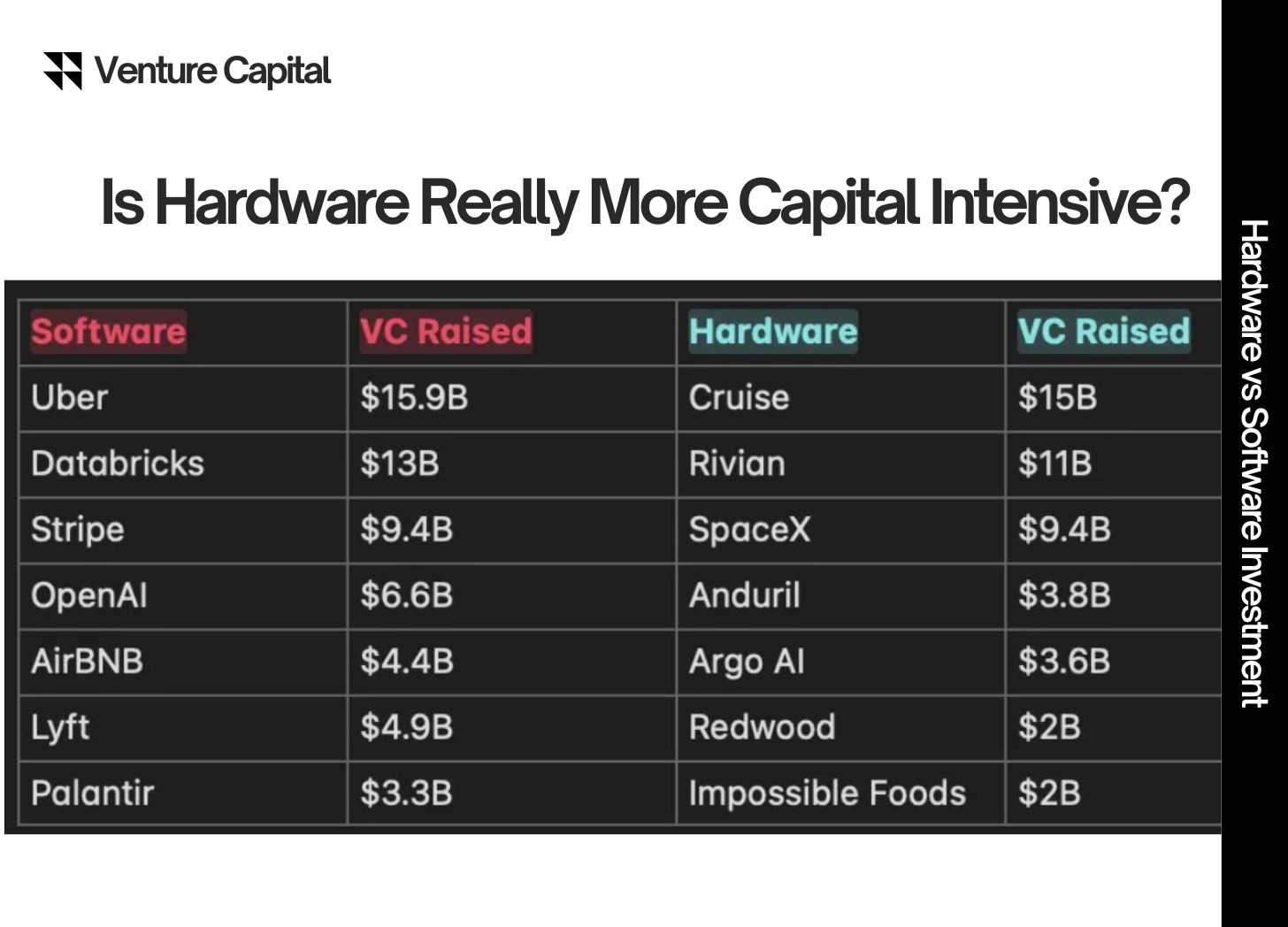

While hardware startups have traditionally been seen as more capital-intensive, the rapid growth of software companies has led them to raise just as much, if not more, venture capital due to scalability, network effects, and market disruption.

Key Points:

Hardware startups require substantial upfront investments in manufacturing, supply chains, and infrastructure.

Software companies raise significant capital to scale rapidly, acquire customers, and build global infrastructure, despite having lower initial production costs.

Venture capital in both sectors is increasingly driven by growth potential, market disruption, and the demand for both software and hardware integration.

In a world where innovation is increasingly digital, why are software companies raising more venture capital than hardware companies, despite a widespread belief that hardware ventures are inherently more capital-intensive? The common assumption is that hardware startups are more expensive to launch due to manufacturing, supply chains, and infrastructure needs, while software companies benefit from lower upfront costs.

While hardware startups may indeed require substantial initial investment, software companies are often raising just as much—if not more—capital as they scale rapidly in a digital-first world. Let’s challenge the long-held belief among investors about the capital intensity of hardware versus software, and take a closer look at the factors driving the large investments in software ventures.

Uber and Cruise: Both Uber and Cruise attracted substantial venture funding, but for different reasons. Uber raised billions to build a global transportation network, focusing on scaling its ride-hailing platform, customer acquisition, and regulatory navigation. The funding was primarily used to establish its market dominance and expand rapidly.

In contrast, Cruise, acquired by General Motors, focuses on developing autonomous vehicle technology, which requires significant investment in R&D, testing, and regulatory compliance. Cruise’s funding was aimed at developing self-driving technology, with a longer-term vision of disrupting the automotive industry.Databricks and Rivian: Databricks, a leader in AI-powered data processing, raised funding to scale its cloud-based platform and further develop its machine learning infrastructure. The investments focused on expanding its customer base and refining its technology stack for enterprises.

Rivian, an electric vehicle startup, raised capital to build out its production capabilities and launch its electric trucks and SUVs. The funding was largely directed toward manufacturing facilities, research and development, and scaling operations, aiming to challenge traditional automakers in the EV space.Stripe and SpaceX: Stripe raised significant funding to expand its global payments platform, focusing on scaling its infrastructure and adding new product offerings. The capital helped it dominate the fintech space by providing seamless solutions for businesses.

On the other hand, SpaceX’s funding was driven by its goal of reducing the cost of space travel and building a reusable rocket system. The focus of its investments was on technological innovation, rocket development, and expanding its commercial satellite operations with an eye toward Mars exploration, making it a capital-intensive endeavor with a long-term vision.OpenAI and Anduril: OpenAI raised capital to advance artificial intelligence, particularly in developing general AI technologies and machine learning models that can benefit various industries. Investors were motivated by the potential impact AI will have on industries ranging from healthcare to finance.

Anduril, a defense technology company, raised funding to develop cutting-edge AI and autonomous systems for military and national security applications. Its funding strategy focuses on modernizing defense systems, with an emphasis on surveillance, robotics, and border security.Airbnb and Argo AI: Airbnb raised significant funds to scale its online marketplace for short-term rentals, investing heavily in marketing, customer acquisition, and global expansion. The capital helped the company refine its platform and extend its reach to international markets.

Argo AI, focused on autonomous driving technology, attracted funding to develop self-driving systems for Ford and Volkswagen. The funding was largely directed toward R&D, testing, and integrating autonomous driving technology into commercial vehicles.Lyft and Redwood: Lyft raised venture funding to compete with Uber in the ride-hailing space, focusing on scaling operations, customer acquisition, and expanding into new cities. Its capital was used to refine its platform, recruit drivers, and improve the rider experience.

Redwood, a battery recycling company, attracted funding to tackle the growing demand for sustainable energy solutions. Investors supported Redwood’s mission to recycle lithium-ion batteries and create a circular economy around renewable energy storage, capitalizing on the booming electric vehicle and renewable energy sectors.Palantir and Impossible Foods: Palantir raised substantial funding to expand its big data analytics software for government and enterprise clients. Investors supported its work in transforming how organizations use data for decision-making, particularly in security and intelligence.

In contrast, Impossible Foods attracted capital to revolutionize the food industry with plant-based alternatives to meat. The company’s funding went into R&D and scaling production capabilities, as investors bet on the long-term sustainability of plant-based protein and the global shift toward more sustainable food sources.

The Traditional View of Hardware Ventures

Historically, hardware companies have been perceived as more capital-intensive. Manufacturing a physical product demands substantial investment in facilities, production equipment, supply chain management, and distribution. For example, companies like Tesla faced high upfront costs for their electric vehicle production, requiring billions of dollars to build factories, create prototypes, and secure raw materials. These expenses can make hardware startups appear riskier and more financially demanding, leading investors to believe that hardware innovation needs far more capital than software.

The complexity of the manufacturing process, coupled with long lead times for prototyping and production, has reinforced the idea that hardware ventures are inherently costlier to develop. From sourcing materials to meeting regulatory standards, hardware products often need more time and money before they are ready for market launch.

How Software Has Disrupted Capital Intensity

Despite the historical view, the rise of software companies has begun to challenge the perception that they require significantly less capital. While it’s true that software companies typically don’t need factories or massive infrastructure to produce their products, they face their own set of capital demands—especially as they scale. The proliferation of cloud computing, open-source software, and SaaS (Software-as-a-Service) models has dramatically lowered the cost of entry for software ventures. Yet, the nature of these companies has led them to raise just as much, if not more, capital than hardware startups.

The critical factor here is scalability. While hardware companies may be limited by physical constraints (such as factory capacity and material costs), software companies can often grow exponentially. However, scaling software products demands substantial funding for research and development, marketing, and customer acquisition. In the tech industry, this means software ventures need capital to build infrastructure, attract customers, and recruit talent to fuel rapid growth.

Take, for example, Uber, a company that revolutionized the transportation industry. Although the company didn’t require heavy investments in manufacturing, it still raised over $25 billion before going public. This capital was used to develop the software platform, acquire drivers, expand into new markets, and address regulatory challenges. Similarly, Airbnb, despite not manufacturing the homes it rents out, raised billions of dollars to scale its digital platform and overcome challenges in the hospitality industry.

Why Software Startups Attract Heavy Investment

So why do software companies raise such large sums of capital despite a lower perceived need for manufacturing resources? Several factors contribute to the heavy investment in software startups:

Scalability and Market Size: Software products, particularly those in SaaS and AI, can be scaled rapidly and reach a global market with minimal marginal costs. For example, once a software product is developed, the cost of serving additional customers is often negligible, allowing the company to expand quickly. Investors are keen to fund these scalable ventures, which promise massive returns on investment. With the global nature of software, the market potential is enormous, and the opportunity to rapidly grow and monetize is highly attractive to VCs.

Network Effects: Many software platforms (such as social networks or collaborative tools) benefit from strong network effects. The value of the product increases as more users adopt it, which creates a flywheel of growth. This phenomenon is particularly visible in companies like Facebook, LinkedIn, and Slack, where user adoption directly drives the value of the service, making software startups even more enticing for investors.

Recurrence and Customer Retention: SaaS and subscription-based software products offer predictable and recurring revenue streams, which provide investors with long-term revenue visibility. The more customers a software company can acquire and retain, the more valuable it becomes over time. This financial predictability makes software startups an appealing choice for venture capitalists seeking lower risk with high returns.

Market Disruption: Software companies have the power to disrupt entire industries, transforming traditional models and unlocking new business opportunities. Companies like Snowflake have demonstrated the vast potential of cloud-based data warehousing, reshaping the data storage market. By addressing critical pain points and offering innovative solutions, software companies can rapidly gain market share, further increasing their attractiveness to VCs.

Case Studies of Software Success Stories

The scale of funding for software ventures today far surpasses that of hardware startups in many cases. For instance, Stripe, the payment processing platform, raised over $2 billion in funding. The company didn’t require a physical factory, but it did invest heavily in acquiring customers, expanding its product suite, and developing global infrastructure. Stripe’s success has been fueled by its ability to scale rapidly, demonstrating how much capital is required to establish a digital platform with global reach.

Similarly, Databricks, an AI-driven cloud data platform, raised over $1 billion in VC funding. Snowflake, a cloud-based data warehousing company, raised $3.4 billion in its IPO and reached a valuation of over $100 billion. These companies are proof that software ventures, especially those in the tech and cloud space, can demand as much capital as hardware companies and, in many cases, even more.

Another striking example is UiPath, a leader in robotic process automation (RPA) software. The company raised over $2 billion in its quest to transform business operations through automation. The scale of the funding required to drive such a transformation speaks volumes about the capital needs of software startups. The fact that these companies are able to raise such large sums underscores the massive potential investors see in the software sector.

Addressing Counterarguments: Hardware's Upfront Costs

It’s important to recognize that hardware companies still have unique challenges that demand significant capital investment, especially when it comes to manufacturing. Physical products need factories, production lines, and logistical systems in place before they can even begin to generate revenue. This has led many to argue that hardware startups are inherently more capital-intensive than software. However, the reality is that software companies now face similar upfront costs in terms of infrastructure, talent acquisition, and market penetration.

For instance, cloud computing services like AWS and Azure, which many software companies rely on, require massive data centers and computational infrastructure, which come with high upfront costs. Moreover, customer acquisition and marketing for SaaS products can quickly become expensive as startups scale. In this sense, the lines between hardware and software investments are becoming increasingly blurred, as both sectors require substantial financial backing to support growth and innovation.

Blurring the Lines Between Hardware and Software Investment

As the boundaries between hardware and software continue to blur—especially with innovations in IoT, AI, and robotics—the distinction between capital-intensive hardware ventures and software startups is becoming less clear. Companies like Tesla that combine hardware with cutting-edge software are raising immense amounts of capital, proving that both sides of the innovation spectrum can demand substantial investments. Similarly, software companies are increasingly raising as much, if not more, capital as hardware ventures due to their rapid scaling potential, market disruption, and the immense infrastructure costs associated with digital products.

Investors are no longer simply choosing between physical products and digital services; they are backing comprehensive ecosystems where both hardware and software work in tandem.